File Your Taxes From Any Mobile Device!

Ready For Your Max Refund?

File Your Taxes From Any Mobile Device Now!

Who We Are...

F & S Tax Service and PS Business Solutions are leading organizations in tax prep, business structuring, career coaching and other related matters. We offer clients a very affordable and professional tax filing and credit repair system.

At F & S Tax service & PS Business Solutions, we aim to provide an efficient, transparent, and error-free computation for all taxpayers which include: Lawyers, Truck Drivers, self-employed workers, college students, and office workers.

Our Virtual Tax solutions assistance makes it easy to file from anywhere in all 50 states!

Who We Are...

F & S Tax Service and PS Business Solutions are leading organizations on tax prep, job placement and other related matters.

We offer clients a very affordable and professional tax and filing systems.

At F & S Tax service and PS Business Solutions, we aim to provide an efficient, transparent, and error-free computation for all taxpayers which include: Lawyers, Truck Drivers, self-employed workers, college students, and office workers.

Our Virtual Tax and solutions makes it easy to assist from anywhere in all 50 states!

STEPS TO USING OUR MOBILE TAX PREP SERVICES

Book Your Appointment w/ Paris Short

Go to the calendar below and book your virtual appointment

Receive Our Mobile App Link

Upon booking your appointment you will receive our mobile app link via text message

Update Your Personal Info

Follow the mobile app link, create your login, add your personal information within the app, and upload all documents

Wait On Paris To Contact You

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

STEPS TO USING OUR MOBILE TAX PREP SERVICES

Book Your w/ Paris Short

Go to the calendar below and book your virtual appointment

Receive Our Mobile App Link

Upon booking your appointment you will receive our mobile app link via text message

Update Your Personal Info

Follow the mobile app link, create your login, add your personal information within the app, and upload all documents

Wait On Paris Short To Contact You

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

F & S Tax Service & PS Business Solutions is a global firm that helps individuals, corporate bodies, professionals, and private sectors to file their returns accurately.

Our tax filing service allows us to give a top-notch experience due to the tax experts we possess in this firm.

You only need to provide us with necessary documents and leave the rest to us; We are committed to being transparent, affordable and accountable for all of our tax paying clients.

F & S Tax Service and PS Business Solutions are global firms that help individuals, corporate bodies, professionals, and private sectors file their returns accurately and educates them on financial literacy.

Our tax filing and allows us to give a top-notch experience due to the expertise we possess in this firm.

You only need to present your information and leave the rest to us;

We are committed to being transparent, affordable and accountable.

TAX PROS WHO BELIEVE IN GETTING YOU THE MAX!

CASH ADVANCES $500-$7,000 STARTING JANUARY 3, 2025

TAX PROS WHO BELIEVE IN GETTING YOU THE MAX CASH ADVANCES $500-$7,000 STARTING JANUARY 2, 2025

BOOK YOUR APPOINTMENT

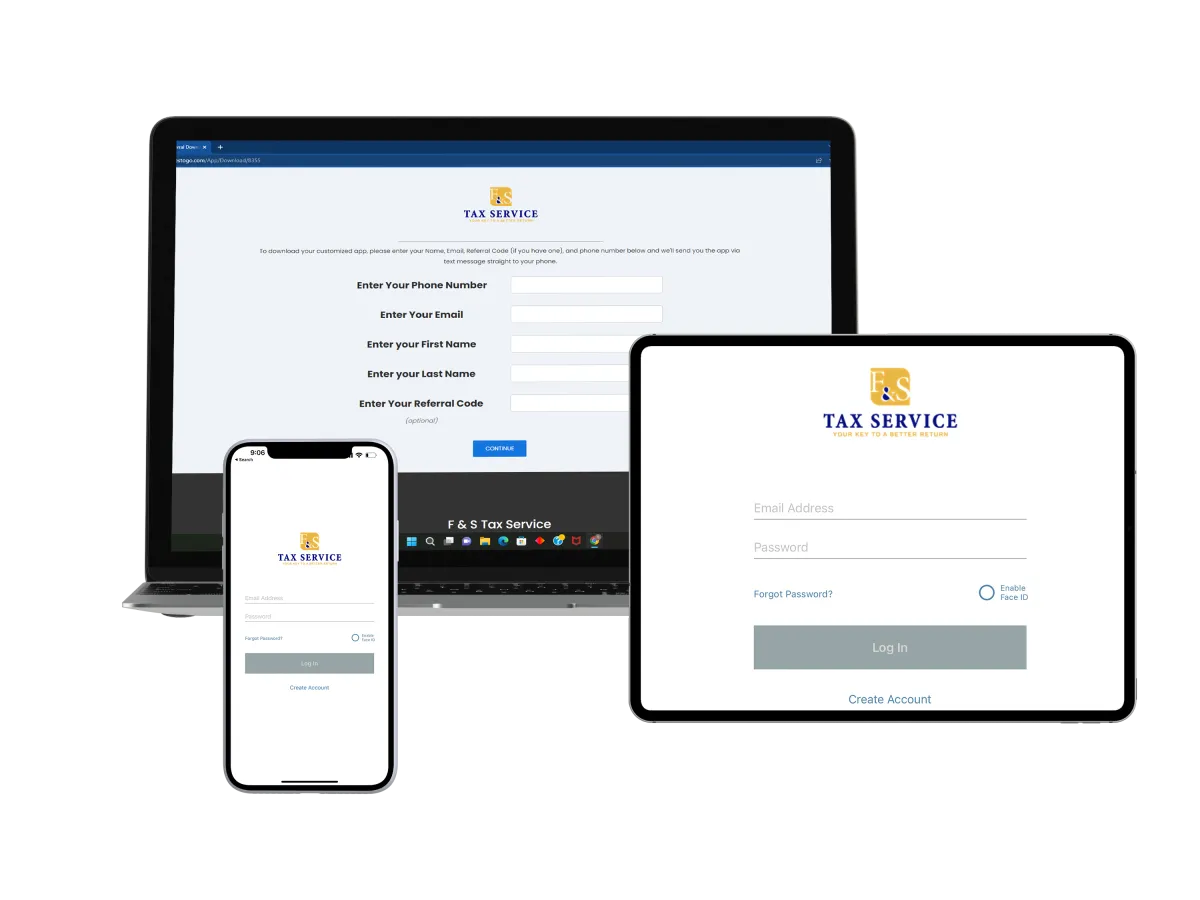

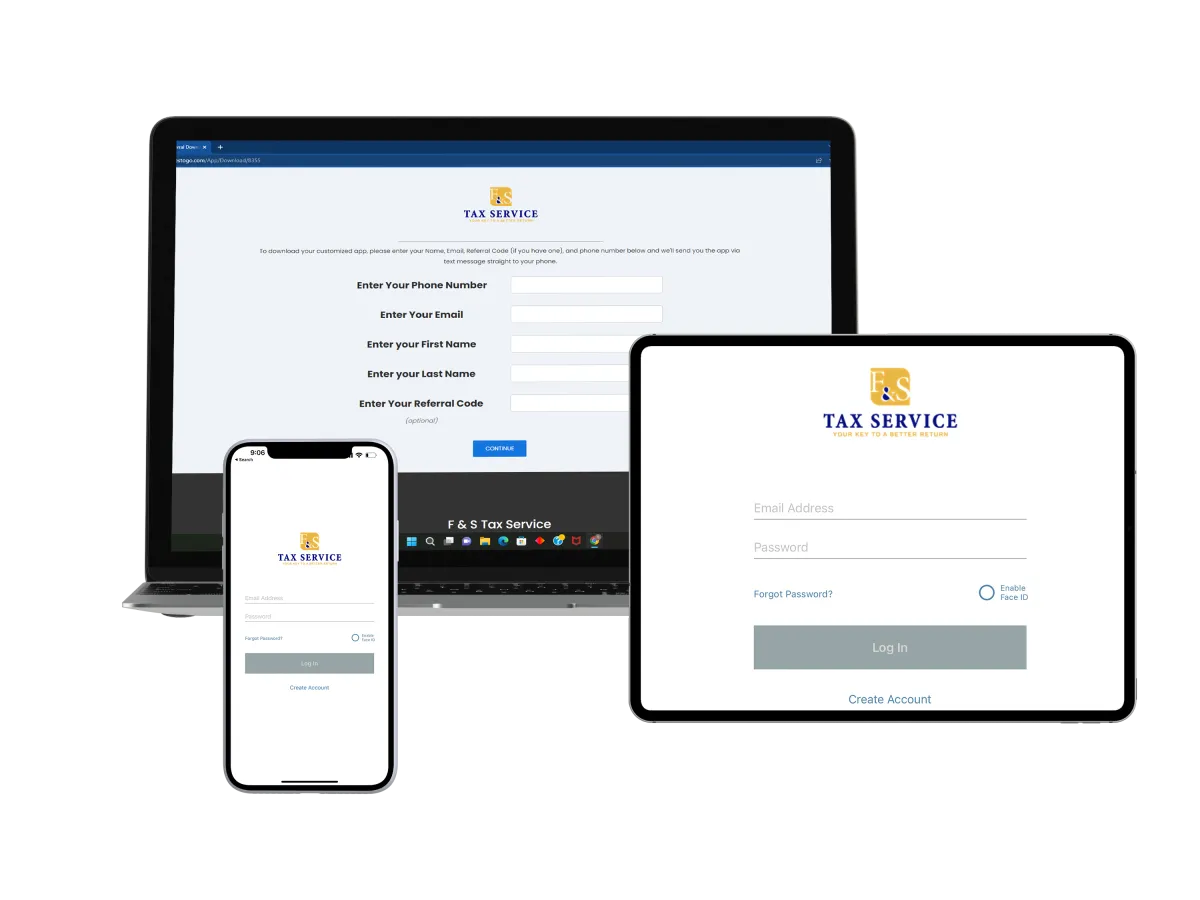

Upon booking your appointment with Paris Short, you will receive a text message with the link to F & S Tax Service Mobile App.

Our mobile app makes filing your return a breeze.

Download our app and upload all necessary documentation needed to complete your return.

Our mobile app allows you to sign your return from your mobile device or desktop, communicate directly with your tax preparer, and also have unlimited access to your completed return.

BOOK YOUR APPOINTMENT

Upon booking your appointment you will receive a text message with the link to F&S Tax Service Mobile App.

Our mobile app makes filing your return a breeze.

Download our app and upload all documentation needed to complete your return.

Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

Paris Short - Your Tax Expert and Credit Repair Coach

Thank you for visiting and potentially choosing F and S Tax Service.

Are you searching for an experienced and reliable tax preparer whom will ensure you receive every dollar that is owed to you?

Are you constantly being overlooked while on your job search?

Are you unsure whether your business is structured correctly or need assistance with setting up a business?

Are you being denied for a new car or would like to purchase a home?

Your search stops here, We would be delighted to assist you!

Paris Short specializes in personalized individual and business tax prep, bookkeeping, business branding/structuring, and resume writing.

With our professional and accurate services, we will maximize your refund, help you land a job, jumpstart your business and minimize any stress!

BOOK YOUR APPOINTMENT

Are you searching for an experienced and reliable tax preparer whom will ensure you receive every dollar that is owed to you?

Are you constantly being overlooked while on your job search?

Are you unsure whether your business is structured correctly or need assistance with setting up a business?

Are you being denied for a new car or would like to purchase a home?

Your search stops here, We would be delighted to assist you!

Paris Short specializes in personalized individual and business tax prep, bookkeeping, business branding/structuring and resume writing.

With our professional and accurate services, we will maximize your refund, help you land a job, jumpstart your business and minimize any stress!

I look forward to working with you!

Best Regards,

Paris Short

WHY CHOOSE US...

1

EASY COMPUTATION AND FILING SYSTEM

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

2

TAX COMPLIANCE & ADVISORY

F & S Tax Service has continuously long gone over and beyond primary tax compliance offerings for each small group of people. We provide innovative, treasured transaction structuring and tax making plans designed to acquire your commercial enterprise and individual goals in the most greenway

3

VIRTUAL TAX PREPARATION

F & S offers tax preparation virtually to all of our clients. File from the comfort of your home and submit all documentation via email, fax, Or simply request a quote/submit all documents on our secured website. We provide our services to Clients in all 50 states.

4

F & S MOBILE TAX PREP APP

Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

WHY CHOOSE US...

1

EASY COMPUTATION AND FILING SYSTEM

After the completion of the mobile app your tax professional will begin working on your tax return. When completed your Tax Pro will contact you with your refund amount and to sign documents.

2

TAX COMPLIANCE & ADVISORY

F & S Tax Service has continuously long gone over and beyond primary tax compliance offerings for each small group of people. We provide innovative, treasured transaction structuring and tax making plans designed to acquire your commercial enterprise and individual goals in the most greenway

3

VIRTUAL TAX PREPARATION

F & S offers tax preparation virtually to all of our clients. File from the comfort of your home and submit all documentation via email, fax, Or simply request a quote/submit all documents on our secured website. We provide our services to Clients in all 50 states.

4

F & S MOBILE TAX PREP APP

Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

TESTIMONIALS

What others are saying

"Paris has done my taxes for over 3 years. The process is always smooth, fast and efficient. If you are needing to get your taxes done, and done right... I highly recommend her services!

- Mark Jones

I've had a really great experience with Paris! She is very polite and answers all my questions to where I understand. She makes sure all information is complete and accurate so I don't have any issues still gaining the max. Highly recommend!

- Marlene Martinez

"Highly recommend this"

Tax time is approaching! You want your taxes done right? File w, Paris Short! She gives excellent customer service, triple checks your return and always updates you on your status. Most importantly, her fees are not outrageous and I am always satisfied. She not only files personal taxes but business taxes too!

- Bridgette Winfrey

Hi, it’s Paris Short here! Your feedback means the world to me. 🌟 If I’ve helped make your tax season smooth and stress-free, let me know by leaving a quick review.

Your words not only brighten my day but also help others discover trusted tax services with F and S Tax Service. Let’s keep the positivity flowing—thank you for being an amazing client! 🙌

FAQ'S

What documents do I need to do my taxes?

Below is a list of documents that you will need in order to get your taxes prepared.

PERSONAL INFORMATION FOR EACH FAMILY MEMBER:Name, Date of Birth, Social Security Card /ITIN/ATIN, Last Year’s Tax, Return, Valid Driver’s License, W2, Business Expenses (If Applicable)

How can I check the status of my refund?

The 'Where’s My Refund' tool on the IRS website provides the most up-to-date information regarding the status of your refund. This tool is updated every 24 hours.

What documents should I receive from my employer?

The forms to prove employment may vary depending on individual situations. For most, an employer will provide a W-2 form. The self-employed (i.e. independent contractors, product sales representatives such as Mary Kay, etc.) should receive a 1099-NEC from the company.

When is the earliest that I can file my taxes?

Self-Employed individuals could file as early as January 3rd. W2 employees would have to wait until they receive their W-2.

FAQ'S

What documents do I need to do my taxes?

Below is a list of documents that you will need in order to get your taxes prepared.

PERSONAL INFORMATION FOR EACH FAMILY MEMBER:Name, Date of Birth, Social Security Card /ITIN/ATIN, Last Year’s Tax, Return, Valid Driver’s License, W2, Business Expenses (If Applicable)

How can I check the status of my refund?

The 'Where’s My Refund' tool on the IRS website provides the most up-to-date information regarding the status of your refund. This tool is updated every 24 hours.

What documents should I receive from my employer?

The forms to prove employment may vary depending on individual situations. For most, an employer will provide a W-2 form. The self-employed (i.e. independent contractors, product sales representatives such as Mary Kay, etc.) should receive a 1099-NEC from the company.

When is the earliest that I can file my taxes?

Self-Employed individuals could file as early as January 3rd. W2 employees would have to wait until they receive their W-2.