FILE YOUR

TAXES FROM

ANY DEVICE

About F & S Tax Service

Empowering Your Business Journey

At F & S Tax Service, our story is one of unwavering commitment to providing excellence in tax services, a story deeply rooted in trust, expertise, and a passion for helping individuals, corporations, professionals, and private sectors navigate the complexities of the tax landscape.

Our Journey

F & S Tax Service was founded on the principle that everyone, regardless of their financial situation, deserves professional and reliable tax services. Our journey began with a vision to make tax filing easier, more affordable, and more accurate for all. Over the years, we have grown and evolved, but our core values have remained the same: transparency, affordability, and accountability.

Welcome to F & S Tax Service

Your Partner in Tax Excellence

Welcome to F & S Tax Service, your trusted partner in the world of tax services. We are here to provide you with top-notch, reliable, and efficient tax solutions, whether you are an individual, a corporation, a professional, or part of the private sector. With our team of seasoned experts and unwavering commitment to excellence, we ensure that your tax returns are filed accurately and stress-free.

At F & S Tax Service, we take pride in offering a tax service that's synonymous with transparency, affordability, and accountability. Our reputation has been built on the solid foundation of trust and accuracy, and we are dedicated to upholding these values in all our interactions with you, our valued clients.

Services

Easy Computation and Filing System

There are two ways to accomplish this action, and you can either access it through an electronic filing system, which is done via the internet, or by manually visiting any of our offices to submit your income tax returns. In recent times, electronic filing system is the preferred choice of taxpayers because you can send it from anywhere.

Tax Compliance and Advisory

F & S Tax Service has continuously long gone over and beyond primary tax compliance offerings for each small group of people. We provide innovative, treasured transaction structuring and tax making plans designed to acquire your commercial enterprise and individual goals in the most greenway

Virtual Tax Preparation

F & S offers tax preparation virtually to all of our clients. File from the comfort of your home and submit all documentation via email, fax, Or simply request a quote/submit all documents on our secured website. We provide our services to Clients in all 50 states.

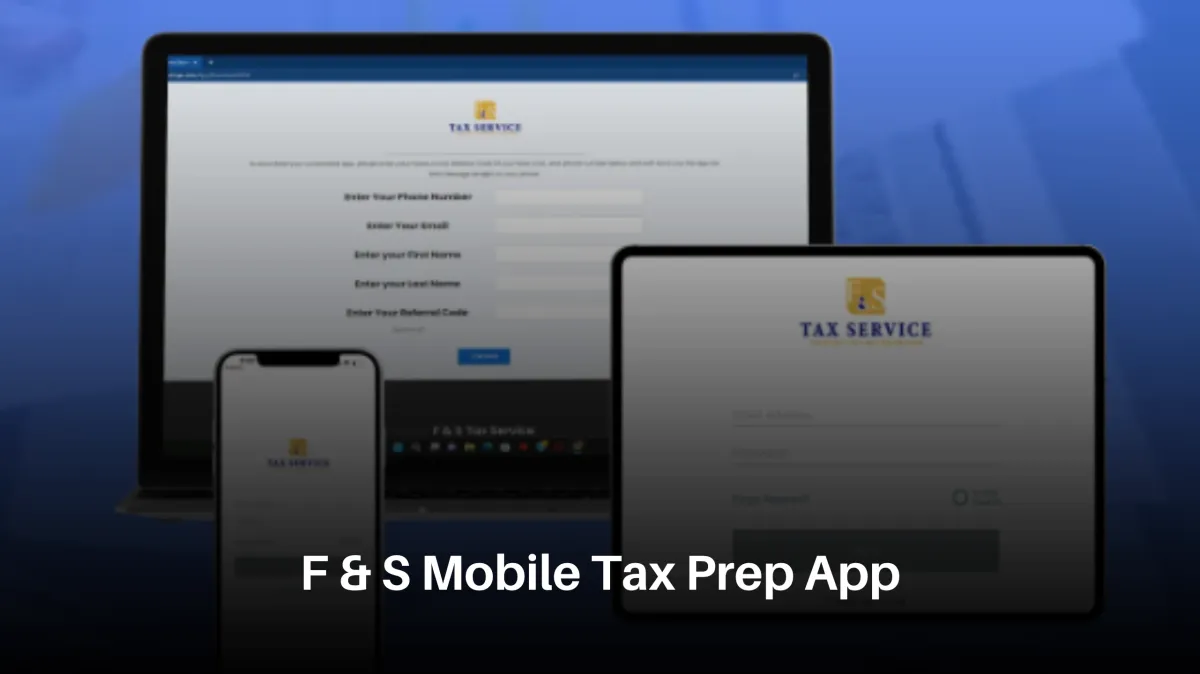

F and S Mobile Tax Prep App

Our mobile app makes filing your return a breeze. Download our app and upload all documentation needed to complete your return. Our mobile app allows you to sign your return from your mobile device, communicate with your tax preparer, and also have unlimited access to your completed return.

F & S Tax Service:

Your Trusted Global Partner for Accurate Tax Filing

At F & S Tax Service, we are a global firm dedicated to facilitating precise tax return filing for individuals, corporate entities, professionals, and private sectors.

Our unrivaled reputation in the industry is a testament to the tax expertise that permeates our organization.

We pride ourselves on offering a seamless tax filing service. You simply need to submit your returns, and we'll take care of the rest. Our commitment is unwavering when it comes to transparency, affordability, and accountability for all taxpayers.

For accurate tax filing, trust F & S Tax Service. We've got you covered.

TAX PROS WHO BELIEVE IN

GETTING YOU THE MAX

CASH ADVANCES $500-$7,000

STARTING JANUARY 3RD

Frequently Asked Questions: Your Path to Financial Clarity

Welcome to our FAQ section! We understand that navigating the world of taxes can be filled with questions. We've compiled some of the most common inquiries to provide you with answers and insights, helping you gain clarity and confidence in your financial journey.

What documents do I need to do my taxes?

Below is a list of documents that you will need in order to get your taxes prepared. PERSONAL INFORMATION FOR EACH FAMILY MEMBER: Name, Date of Birth, Social Security Card /ITIN/ATIN, Last Year’s Tax, Return, Valid Driver’s License, W2, Business Expenses (If Applicable)

How can I check the status of my refund?

The 'Where’s My Refund' tool on the IRS website provides the most up-to-date information regarding the status of your refund. This tool is updated every 24 hours.

What documents should I receive from my employer?

The forms to prove employment may vary depending on individual situations. For most, an employer will provide a W-2 form. The self-employed (i.e. independent contractors, product sales representatives such as Mary Kay, etc.) should receive a 1099-NEC from the company.

When is the earliest that I can file my taxes?

Self-Employed individuals could file as early as January 3rd. W2 employees would have to wait until they receive their W-2.